SAN FRANCISCO--(BUSINESS WIRE)--The Charles Schwab Corporation announced today that its net income for the third quarter of 2015 was $376 million, up 7% from $353 million for the second quarter of 2015, and up 17% from $321 million for the third quarter of 2014. Net income for the nine months ended September 30, 2015 was $1.0 billion, up 6% from the year-earlier period. The company’s financial results for the third quarter and first nine months of both 2015 and 2014 include certain non-recurring items; descriptions of these items are included below.

| Three Months Ended |

Nine Months Ended |

|||||||||||||||||||||

| --September 30,-- | % | --September 30,-- | % | |||||||||||||||||||

| Financial Highlights | 2015 | 2014 | Change | 2015 | 2014 | Change | ||||||||||||||||

| Net revenues (in millions) | $ | 1,597 | $ | 1,551 | 3 | % | $ | 4,689 | $ | 4,507 | 4 | % | ||||||||||

| Net income (in millions) | $ | 376 | $ | 321 | 17 | % | $ | 1,031 | $ | 971 | 6 | % | ||||||||||

| Diluted earnings per common share | $ | .28 | $ | .24 | 17 | % | $ | .74 | $ | .70 | 6 | % | ||||||||||

| Pre-tax profit margin | 36.5 | % | 33.4 | % | 34.9 | % | 34.6 | % | ||||||||||||||

|

Return on average common stockholders’ equity (annualized) |

13 | % | 12 | % | 12 | % | 12 | % | ||||||||||||||

| EPS Impact of Certain Non-Recurring Items | ||||||||||||||||||||||

| $14 million net tax benefits | $ | .01 | $ | - | $ | .01 | $ | - | ||||||||||||||

| (included in Taxes on income) | ||||||||||||||||||||||

| $17 million litigation proceeds | $ | - | $ | - | $ | .01 | $ | - | ||||||||||||||

| (included in Other revenue) | ||||||||||||||||||||||

| $45 million net insurance recovery | $ | - | $ | .02 | $ | - | $ | .02 | ||||||||||||||

| (included in Other revenue) | ||||||||||||||||||||||

| $68 million charge relating to geographic | $ | - | $ | (.03 | ) | $ | - | $ | (.03 | ) | ||||||||||||

|

footprint (included in Compensation and benefits expense) |

||||||||||||||||||||||

|

|

||||||||||||||||||||||

CEO Walt Bettinger said, “Schwab’s third quarter results reflect the continued success of our ‘through clients’ eyes’ strategy and our contemporary approach to helping clients manage their wealth. As we helped investors navigate recent market volatility, we also drove solid business growth. Core net new assets were $30.8 billion in the third quarter, bringing our year-to-date total to $102.0 billion. In addition, clients opened 254,000 new brokerage accounts, up 11% year-over-year. Faced with economic uncertainty and the resulting market volatility, investors increasingly turned to our advice offerings throughout the quarter. Approximately 36,000 accounts enrolled in one of our retail advisory solutions during the last three months, 57% more than the year-earlier period, and total accounts using these solutions reached 550,000, up 13% year-over-year. Total client assets were $2.42 trillion, up 1% from a year ago, reflecting the $117.5 billion impact of reduced market valuations on client portfolios over the last 12 months. We finished the quarter serving 9.7 million brokerage accounts, 1.0 million banking accounts, and 1.5 million retirement plan participants, up 4%, 6% and 6%, respectively, from a year ago.”

“Schwab has built out a wide range of full-service investing and wealth management capabilities to support investors through market conditions like those experienced this August,” Mr. Bettinger continued. “During that month, the S&P 500® dropped 11% in six trading days and the CBOE Volatility Index® spiked to 41 on the 24th after averaging 14 for the prior four weeks. Throughout this period, we proactively engaged investors across multiple channels to discuss developments and appropriate courses of action. Schwab’s senior investment strategists and other experts shared our point of view through a series of published perspectives; TV, radio and print news stories; and recorded video commentaries. As volatility peaked, we reached out to over 4.5 million clients and prospects via email, helping connect them with our insights and service representatives. During the week of August 24th, client and prospect visits to our website increased 35% and 58%, respectively, from the prior week. At the same time, total calls to Schwab representatives increased 26%.”

Mr. Bettinger added, “While providing these resources for dealing with market turbulence, Schwab continued with ongoing initiatives to enhance our clients’ financial lives, including the security of their accounts and assets. For nearly 10 years, Schwab has provided a Security Guarantee that covers 100% of any losses in Schwab accounts due to unauthorized activity. To better support our clients’ desire to be active partners in safe online security practices, we recently introduced SchwabSafe™, an online resource with perspectives and tips on cyber security. In the third quarter, we also announced the addition of one new ETF provider – J.P. Morgan Asset Management – and nine new ETFs to Schwab ETF OneSource™. This expansion gives investors more choice within two popular categories: currency-hedged ETFs and strategic beta funds across U.S. and international markets. Schwab ETF OneSource continues to provide investors and advisors with access to the most commission-free ETFs anywhere in our industry.”

CFO Joe Martinetto commented, “Our diversified revenue sources continued to support solid financial performance during the third quarter, even in the face of deteriorating equity market valuations. Broad market declines limited asset management and administration fees to $663 million, or 2% growth year-over-year. At the same time, however, the environment helped drive strong growth in our other two main revenue sources. Organic balance sheet growth and a slight uptick in short term interest rates contributed to net interest revenue of $635 million, up 11% from the third quarter of 2014. August market volatility, which culminated in a record number of client revenue trades on the 24th, helped lift trading revenue to $228 million, up 9%. Total net revenues of $1.6 billion represent a record for a third quarter, as well as a 3% increase from a year ago. Our third quarter expenses of $1.0 billion kept us on track for planned full-year expense growth of approximately 4% and enabled us to produce a pre-tax profit margin of 36.5%, our highest since the fourth quarter of 2008. We recognized net tax benefits of approximately $14 million in the third quarter relating to certain prior-year matters. Overall, net income totaled $376 million, the highest quarter in our history save those affected by the sale of US Trust. Our year-to-date earnings of $1.0 billion are also the highest in our history despite the mixed revenue environment that has unfolded in 2015.”

Mr. Martinetto concluded, “In the midst of heightened economic uncertainty and market volatility, our financial discipline remains the same – managing the levers that are under our control to ensure flexibility, continuing to maintain a healthy balance sheet, and actively working to more effectively monetize client cash balances. We are in the process of utilizing our recent $600 million preferred issuance to support approximately $4.0 billion in bulk transfers of cash sweep balances from money market funds to Schwab Bank. We completed the first $1.1 billion transfer in September, and plan to move the remainder during the fourth quarter.”

Business highlights for the third quarter (data as of quarter-end unless otherwise noted):

Investor Services

- New retail brokerage accounts for the quarter totaled approximately 158,000, up 12% year-over-year; total accounts were 6.8 million as of September 30, 2015, up 1% year-over-year.

- Held financial planning conversations with approximately 29,000 clients, up 7% year-over-year.

- Launched the Schwab One® Visa® Chip Platinum debit card, enhancing security and reducing the chance of failed transactions for clients traveling in more than 130 countries, where chip readers are now standard.

- Enhanced flexibility for Schwab.com passwords – clients may now create passwords with up to 234 characters, including special and case-sensitive characters.

- Added an “Ideas” tab to Trade Source™, Schwab’s specialized web interface for traders, enabling users to search for stocks based on nine strategic predefined screens that can be used as starting points for potential trade ideas.

Advisor Services

- Held our annual SOLUTIONS events in 12 cities across the country, helping advisors discover how our technology and tools can streamline workflow, optimize performance and support exceptional client service.

- Added two funds to Schwab Alternative Investment OneSource™, a platform that provides advisors and their clients with access to alternative investment funds registered under the Securities Act of 1933. At quarter-end, 31 funds were available on the platform.

Products and Infrastructure

-

For Charles Schwab Bank:

- Balance sheet assets = $128.7 billion, up 22% year-over-year.

- Outstanding mortgage and home equity loans = $11.1 billion, comparable to a year ago.

- Pledged Asset Line® balances = $3.2 billion, up 56% year-over-year.

- Delinquency, nonaccrual, and loss reserve ratios for Schwab Bank’s loan portfolio = 0.20%, 0.18% and 0.22%, respectively, at month-end September.

- Schwab Bank High Yield Investor Checking® accounts = 836,000, with $12.2 billion in balances.

- Client assets managed by Windhaven® totaled $12.9 billion, down 27% from the third quarter of 2014.

- Client assets managed by ThomasPartners® totaled $6.8 billion, up 11% from the third quarter of 2014.

- Client assets managed by Intelligent Portfolios (Schwab Intelligent Portfolios™ and Institutional Intelligent Portfolios™) totaled $4.1 billion, up $1.1 billion from the second quarter of 2015.

- Expanded Schwab ETF OneSource to offer nine more ETFs; at quarter-end, investors could trade 209 ETFs from 14 providers covering 66 Morningstar Categories, for $0 online trade commissions.

- Introduced SchwabSafe, an online resource with perspectives and tips on cyber security that helps clients learn about safe online security practices applicable to all aspects of online commerce.

Supporting schedules are either attached or located at: http://www.aboutschwab.com/investor-relations/financial-reports.

Commentary from the CFO

Joe Martinetto, Senior Executive Vice President and Chief Financial Officer, provides insight and commentary regarding Schwab’s financial picture at: http://www.aboutschwab.com/investor-relations/cfo-commentary. The most recent commentary was posted on September 15, 2015.

Forward-Looking Statements

This press release contains forward-looking statements relating to expense growth; financial discipline; maintaining a healthy balance sheet; monetization of client cash balances; and the timing and amount of bulk transfers of cash sweep balances. Achievement of these expectations and objectives is subject to risks and uncertainties that could cause actual results to differ materially from the expressed expectations.

Important factors that may cause such differences include, but are not limited to, the company’s ability to manage expenses; the timing and amount of severance and other costs related to reducing the company’s San Francisco footprint; the effect of adverse developments in litigation or regulatory matters and the extent of any charges associated with legal matters; any adverse impact of financial reform legislation and related regulations; regulatory guidance; general market conditions, including the level of interest rates, equity valuations and trading activity; the level of client assets, including cash balances; the company’s ability to attract and retain clients and grow client assets/relationships; the quality of the company’s balance sheet assets; capital needs and management; the company’s ability to monetize client assets; client sensitivity to interest rates; and other factors set forth in the company’s most recent reports on Form 10-K and Form 10-Q.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading provider of financial services, with more than 325 offices and 9.7 million active brokerage accounts, 1.5 million corporate retirement plan participants, 1.0 million banking accounts, and $2.42 trillion in client assets as of September 30, 2015. Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, money management and financial advisory services to individual investors and independent investment advisors. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (member SIPC, http://www.sipc.org), and affiliates offer a complete range of investment services and products including an extensive selection of mutual funds; financial planning and investment advice; retirement plan and equity compensation plan services; referrals to independent fee-based investment advisors; and custodial, operational and trading support for independent, fee-based investment advisors through Schwab Advisor Services. Its banking subsidiary, Charles Schwab Bank (member FDIC and an Equal Housing Lender), provides banking and lending services and products. More information is available at www.schwab.com and www.aboutschwab.com.

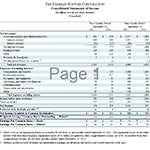

| THE CHARLES SCHWAB CORPORATION | ||||||||||||||||

| Consolidated Statements of Income | ||||||||||||||||

| (In millions, except per share amounts) | ||||||||||||||||

| (Unaudited) | ||||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Net Revenues | ||||||||||||||||

| Asset management and administration fees | $ | 663 | $ | 649 | $ | 1,977 | $ | 1,892 | ||||||||

| Interest revenue | 669 | 600 | 1,931 | 1,767 | ||||||||||||

| Interest expense | (34 | ) | (27 | ) | (96 | ) | (79 | ) | ||||||||

| Net interest revenue | 635 | 573 | 1,835 | 1,688 | ||||||||||||

| Trading revenue | 228 | 209 | 658 | 668 | ||||||||||||

| Other | 66 | 120 | 208 | 253 | ||||||||||||

| Provision for loan losses | 5 | 1 | 11 | 7 | ||||||||||||

| Net impairment losses on securities (1) | - | (1 | ) | - | (1 | ) | ||||||||||

| Total net revenues | 1,597 | 1,551 | 4,689 | 4,507 | ||||||||||||

| Expenses Excluding Interest | ||||||||||||||||

| Compensation and benefits | 548 | 593 | 1,669 | 1,641 | ||||||||||||

| Professional services | 114 | 117 | 340 | 335 | ||||||||||||

| Occupancy and equipment | 92 | 82 | 260 | 242 | ||||||||||||

| Advertising and market development | 58 | 59 | 189 | 187 | ||||||||||||

| Communications | 58 | 55 | 175 | 168 | ||||||||||||

| Depreciation and amortization | 57 | 49 | 166 | 145 | ||||||||||||

| Other | 87 | 78 | 256 | 228 | ||||||||||||

| Total expenses excluding interest | 1,014 | 1,033 | 3,055 | 2,946 | ||||||||||||

| Income before taxes on income | 583 | 518 | 1,634 | 1,561 | ||||||||||||

| Taxes on income | 207 | 197 | 603 | 590 | ||||||||||||

| Net Income | 376 | 321 | 1,031 | 971 | ||||||||||||

| Preferred stock dividends and other (2) | 11 | 9 | 45 | 39 | ||||||||||||

| Net Income Available to Common Stockholders | $ | 365 | $ | 312 | $ | 986 | $ | 932 | ||||||||

| Weighted-Average Common Shares Outstanding — Diluted | 1,328 | 1,316 | 1,326 | 1,313 | ||||||||||||

| Earnings Per Common Share — Basic | $ | .28 | $ | .24 | $ | .75 | $ | .71 | ||||||||

| Earnings Per Common Share — Diluted | $ | .28 | $ | .24 | $ | .74 | $ | .70 | ||||||||

| (1) | There were no net impairment losses on securities for the three or nine months ended September 30, 2015. Net impairment losses on securities include total other-than-temporary impairment losses of $1 million recognized in other comprehensive income, net of $0 reclassified from other comprehensive income, for the three and nine months ended September 30, 2014. | |

| (2) | Includes preferred stock dividends and undistributed earnings and dividends allocated to non-vested restricted stock units. | |

| THE CHARLES SCHWAB CORPORATION | ||||||||||||||||||||||||||||||||

| Financial and Operating Highlights | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

|

Q3-15 % change |

2015 | 2014 | ||||||||||||||||||||||||||||||

| vs. | vs. | Third | Second | First | Fourth | Third | ||||||||||||||||||||||||||

| (In millions, except per share amounts and as noted) | Q3-14 | Q2-15 | Quarter | Quarter | Quarter | Quarter | Quarter | |||||||||||||||||||||||||

| Net Revenues | ||||||||||||||||||||||||||||||||

| Asset management and administration fees | 2 | % | (1 | %) | $ | 663 | $ | 670 | $ | 644 | $ | 641 | $ | 649 | ||||||||||||||||||

| Net interest revenue | 11 | % | 4 | % | 635 | 612 | 588 | 584 | 573 | |||||||||||||||||||||||

| Trading revenue | 9 | % | 12 | % | 228 | 203 | 227 | 239 | 209 | |||||||||||||||||||||||

| Other (1) | (45 | %) | (16 | %) | 66 | 79 | 63 | 90 | 119 | |||||||||||||||||||||||

| Provision for loan losses | N/M | 150 | % | 5 | 2 | 4 | (3 | ) | 1 | |||||||||||||||||||||||

| Total net revenues | 3 | % | 2 | % | 1,597 | 1,566 | 1,526 | 1,551 | 1,551 | |||||||||||||||||||||||

| Expenses Excluding Interest | ||||||||||||||||||||||||||||||||

| Compensation and benefits | (8 | %) | 1 | % | 548 | 540 | 581 | 543 | 593 | |||||||||||||||||||||||

| Professional services | (3 | %) | 2 | % | 114 | 112 | 114 | 122 | 117 | |||||||||||||||||||||||

| Occupancy and equipment | 12 | % | 8 | % | 92 | 85 | 83 | 82 | 82 | |||||||||||||||||||||||

| Advertising and market development | (2 | %) | (6 | %) | 58 | 62 | 69 | 58 | 59 | |||||||||||||||||||||||

| Communications | 5 | % | (2 | %) | 58 | 59 | 58 | 55 | 55 | |||||||||||||||||||||||

| Depreciation and amortization | 16 | % | 4 | % | 57 | 55 | 54 | 54 | 49 | |||||||||||||||||||||||

| Other | 12 | % | 1 | % | 87 | 86 | 83 | 83 | 78 | |||||||||||||||||||||||

| Total expenses excluding interest | (2 | %) | 2 | % | 1,014 | 999 | 1,042 | 997 | 1,033 | |||||||||||||||||||||||

| Income before taxes on income | 13 | % | 3 | % | 583 | 567 | 484 | 554 | 518 | |||||||||||||||||||||||

| Taxes on income | 5 | % | (3 | %) | 207 | 214 | 182 | 204 | 197 | |||||||||||||||||||||||

| Net Income | 17 | % | 7 | % | $ | 376 | $ | 353 | $ | 302 | $ | 350 | $ | 321 | ||||||||||||||||||

| Preferred stock dividends and other | 22 | % | (52 | %) | 11 | 23 | 11 | 21 | 9 | |||||||||||||||||||||||

| Net Income Available to Common Stockholders | 17 | % | 11 | % | $ | 365 | $ | 330 | $ | 291 | $ | 329 | $ | 312 | ||||||||||||||||||

| Basic earnings per common share | 17 | % | 12 | % | $ | .28 | $ | .25 | $ | .22 | $ | .25 | $ | .24 | ||||||||||||||||||

| Diluted earnings per common share | 17 | % | 12 | % | $ | .28 | $ | .25 | $ | .22 | $ | .25 | $ | .24 | ||||||||||||||||||

| Dividends declared per common share | - | - | $ | .06 | $ | .06 | $ | .06 | $ | .06 | $ | .06 | ||||||||||||||||||||

| Weighted-average common shares outstanding - diluted | 1 | % | - | 1,328 | 1,326 | 1,323 | 1,320 | 1,316 | ||||||||||||||||||||||||

| Performance Measures | ||||||||||||||||||||||||||||||||

| Pre-tax profit margin | 36.5 | % | 36.2 | % | 31.7 | % | 35.7 | % | 33.4 | % | ||||||||||||||||||||||

| Return on average common stockholders’ equity (annualized) (2) | 13 | % | 12 | % | 10 | % | 12 | % | 12 | % | ||||||||||||||||||||||

| Financial Condition (at quarter end, in billions) | ||||||||||||||||||||||||||||||||

| Cash and investments segregated | (14 | %) | (4 | %) | $ | 17.2 | $ | 17.9 | $ | 19.4 | $ | 20.8 | $ | 19.9 | ||||||||||||||||||

| Receivables from brokerage clients | 11 | % | 3 | % | 17.1 | 16.6 | 16.0 | 15.7 | 15.4 | |||||||||||||||||||||||

| Bank loans | 9 | % | 2 | % | 14.3 | 14.0 | 13.6 | 13.4 | 13.1 | |||||||||||||||||||||||

| Total assets | 16 | % | 4 | % | 170.4 | 163.6 | 160.2 | 154.6 | 147.4 | |||||||||||||||||||||||

| Bank deposits | 22 | % | 5 | % | 119.0 | 112.9 | 109.5 | 102.8 | 97.3 | |||||||||||||||||||||||

| Payables to brokerage clients | (6 | %) | (2 | %) | 31.0 | 31.5 | 31.6 | 34.3 | 33.1 | |||||||||||||||||||||||

| Long-term debt | 53 | % | - | 2.9 | 2.9 | 2.9 | 1.9 | 1.9 | ||||||||||||||||||||||||

| Stockholders’ equity | 15 | % | 6 | % | 13.2 | 12.4 | 12.2 | 11.8 | 11.5 | |||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||||||||

| Full-time equivalent employees (at quarter end, in thousands) | 8 | % | 3 | % | 15.4 | 14.9 | 14.9 | 14.6 | 14.3 | |||||||||||||||||||||||

|

Capital expenditures - purchases of equipment, office facilities, and property, net (in millions) |

(45 | %) | 4 | % | $ | 80 | $ | 77 | $ | 61 | $ | 90 | $ | 146 | ||||||||||||||||||

|

Expenses excluding interest as a percentage of average client assets (annualized) |

0.16 | % | 0.16 | % | 0.17 | % | 0.17 | % | 0.18 | % | ||||||||||||||||||||||

| Clients’ Daily Average Trades (in thousands) | ||||||||||||||||||||||||||||||||

| Revenue trades (3) | 13 | % | 14 | % | 304 | 267 | 313 | 315 | 269 | |||||||||||||||||||||||

| Asset-based trades (4) | 31 | % | 8 | % | 84 | 78 | 88 | 80 | 64 | |||||||||||||||||||||||

| Other trades (5) | 10 | % | - | 149 | 149 | 181 | 169 | 136 | ||||||||||||||||||||||||

| Total | 14 | % | 9 | % | 537 | 494 | 582 | 564 | 469 | |||||||||||||||||||||||

| Average Revenue Per Revenue Trade (3) | (5 | %) | (3 | %) | $ | 11.67 | $ | 11.97 | $ | 11.98 | $ | 12.04 | $ | 12.24 | ||||||||||||||||||

| Note: Certain prior-period amounts have been reclassified to conform to the 2015 presentation. | ||

| (1) | Includes net impairment losses on securities of $(1) million in the third quarter of 2014. | |

| (2) | Return on average common stockholders’ equity is calculated using net income available to common stockholders divided by average common stockholders’ equity. | |

| (3) | Includes all client trades that generate either commission revenue or revenue from principal markups (i.e., fixed income); also known as DART. | |

| (4) | Includes eligible trades executed by clients who participate in one or more of the Company’s asset-based pricing relationships. | |

| (5) | Includes all commission-free trades, including Schwab Mutual Fund OneSource® funds and ETFs, and other proprietary products. | |

| N/M Not meaningful | ||

| THE CHARLES SCHWAB CORPORATION | |||||||||||||||||||||||||||||||||||||

| Net Interest Revenue Information | |||||||||||||||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||

| September 30, | September 30, | ||||||||||||||||||||||||||||||||||||

| 2015 | 2014 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||

| Interest | Average | Interest | Average | Interest | Average | Interest | Average | ||||||||||||||||||||||||||||||

| Average | Revenue/ | Yield/ | Average | Revenue/ | Yield/ | Average | Revenue/ | Yield/ | Average | Revenue/ | Yield/ | ||||||||||||||||||||||||||

| Balance | Expense | Rate | Balance | Expense | Rate | Balance | Expense | Rate | Balance | Expense | Rate | ||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 9,764 | $ | 6 | 0.24 | % | $ | 7,961 | $ | 4 | 0.20 | % | $ | 9,230 | $ | 17 | 0.25 | % | $ | 6,892 | $ | 11 | 0.21 | % | |||||||||||||

| Cash and investments segregated | 18,061 | 8 | 0.18 | % | 19,542 | 6 | 0.12 | % | 18,607 | 21 | 0.15 | % | 20,251 | 18 | 0.12 | % | |||||||||||||||||||||

| Broker-related receivables (1) | 312 | - | 0.09 | % | 363 | - | 0.01 | % | 285 | - | 0.07 | % | 323 | - | 0.10 | % | |||||||||||||||||||||

| Receivables from brokerage clients | 15,594 | 130 | 3.31 | % | 13,965 | 122 | 3.47 | % | 15,043 | 374 | 3.32 | % | 13,589 | 358 | 3.52 | % | |||||||||||||||||||||

| Securities available for sale (2) | 63,916 | 159 | 0.99 | % | 51,425 | 135 | 1.04 | % | 60,866 | 454 | 1.00 | % | 51,984 | 413 | 1.06 | % | |||||||||||||||||||||

| Securities held to maturity | 38,533 | 241 | 2.48 | % | 32,609 | 208 | 2.53 | % | 36,637 | 686 | 2.50 | % | 31,839 | 613 | 2.57 | % | |||||||||||||||||||||

| Bank loans | 14,137 | 93 | 2.61 | % | 13,001 | 89 | 2.72 | % | 13,848 | 274 | 2.65 | % | 12,776 | 264 | 2.76 | % | |||||||||||||||||||||

| Total interest-earning assets | 160,317 | 637 | 1.58 | % | 138,866 | 564 | 1.61 | % | 154,516 | 1,826 | 1.58 | % | 137,654 | 1,677 | 1.63 | % | |||||||||||||||||||||

| Other interest revenue | 32 | 36 | 105 | 90 | |||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 160,317 | $ | 669 | 1.66 | % | $ | 138,866 | $ | 600 | 1.72 | % | $ | 154,516 | $ | 1,931 | 1.67 | % | $ | 137,654 | $ | 1,767 | 1.72 | % | |||||||||||||

| Funding sources: | |||||||||||||||||||||||||||||||||||||

| Bank deposits | $ | 115,606 | $ | 8 | 0.03 | % | $ | 96,114 | $ | 7 | 0.03 | % | $ | 110,569 | $ | 22 | 0.03 | % | $ | 94,951 | $ | 22 | 0.03 | % | |||||||||||||

| Payables to brokerage clients | 25,585 | 1 | 0.01 | % | 26,403 | 1 | 0.01 | % | 25,596 | 2 | 0.01 | % | 26,652 | 2 | 0.01 | % | |||||||||||||||||||||

| Long-term debt | 2,900 | 24 | 3.28 | % | 1,900 | 19 | 3.97 | % | 2,652 | 67 | 3.38 | % | 1,901 | 55 | 3.87 | % | |||||||||||||||||||||

| Total interest-bearing liabilities | 144,091 | 33 | 0.09 | % | 124,417 | 27 | 0.09 | % | 138,817 | 91 | 0.09 | % | 123,504 | 79 | 0.09 | % | |||||||||||||||||||||

| Non-interest-bearing funding sources | 16,226 | 14,449 | 15,699 | 14,150 | |||||||||||||||||||||||||||||||||

| Other interest expense (1,3) | 1 | - | 5 | - | |||||||||||||||||||||||||||||||||

| Total funding sources | $ | 160,317 | $ | 34 | 0.09 | % | $ | 138,866 | $ | 27 | 0.08 | % | $ | 154,516 | $ | 96 | 0.08 | % | $ | 137,654 | $ | 79 | 0.08 | % | |||||||||||||

| Net interest revenue | $ | 635 | 1.57 | % | $ | 573 | 1.64 | % | $ | 1,835 | 1.59 | % | $ | 1,688 | 1.64 | % | |||||||||||||||||||||

| (1) | Interest revenue or expense was less than $500,000 in the period or periods presented. | |

| (2) | Amounts have been calculated based on amortized cost. | |

| (3) | Includes the impact of capitalizing interest on building construction and software development. | |

| THE CHARLES SCHWAB CORPORATION | |||||||||||||||||||||||||||||||||||||||||

| Asset Management and Administration Fees Information | |||||||||||||||||||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||

| September 30, | September 30, | ||||||||||||||||||||||||||||||||||||||||

| 2015 | 2014 | 2015 | 2014 | ||||||||||||||||||||||||||||||||||||||

| Average | Average | Average | Average | ||||||||||||||||||||||||||||||||||||||

| Client | Average | Client | Average | Client | Average | Client | Average | ||||||||||||||||||||||||||||||||||

| Assets | Revenue | Fee | Assets | Revenue | Fee | Assets | Revenue | Fee | Assets | Revenue | Fee | ||||||||||||||||||||||||||||||

|

Schwab money market funds before fee waivers |

$ | 160,266 | $ | 237 | 0.59 | % | $ | 162,805 | $ | 240 | 0.58 | % | $ | 161,029 | $ | 706 | 0.59 | % | $ | 164,208 | $ | 714 | 0.58 | % | |||||||||||||||||

| Fee waivers | (166 | ) | (190 | ) | (519 | ) | (558 | ) | |||||||||||||||||||||||||||||||||

| Schwab money market funds | 160,266 | 71 | 0.18 | % | 162,805 | 50 | 0.12 | % | 161,029 | 187 | 0.16 | % | 164,208 | 156 | 0.13 | % | |||||||||||||||||||||||||

| Schwab equity and bond funds (1) | 102,898 | 55 | 0.21 | % | 86,416 | 50 | 0.23 | % | 101,337 | 163 | 0.22 | % | 81,770 | 142 | 0.23 | % | |||||||||||||||||||||||||

| Mutual Fund OneSource ® (2) | 230,235 | 188 | 0.32 | % | 249,427 | 208 | 0.33 | % | 239,633 | 585 | 0.33 | % | 246,210 | 609 | 0.33 | % | |||||||||||||||||||||||||

| Total mutual funds (3) | $ | 493,399 | 314 | 0.25 | % | $ | 498,648 | 308 | 0.25 | % | $ | 501,999 | 935 | 0.25 | % | $ | 492,188 | 907 | 0.25 | % | |||||||||||||||||||||

| Advice solutions (3) : | |||||||||||||||||||||||||||||||||||||||||

| Fee-based | $ | 170,211 | 225 | 0.52 | % | $ | 161,783 | 215 | 0.53 | % | $ | 171,516 | 673 | 0.52 | % | $ | 155,970 | 623 | 0.53 | % | |||||||||||||||||||||

| Intelligent Portfolios | 3,714 | - | - | N/A | N/A | N/A | 2,578 | - | - | N/A | N/A | N/A | |||||||||||||||||||||||||||||

| Legacy Non-Fee | 16,372 | N/A | N/A | 16,021 | N/A | N/A | 16,573 | N/A | N/A | 15,717 | N/A | N/A | |||||||||||||||||||||||||||||

| Total advice solutions | $ | 190,297 | 225 | 0.47 | % | $ | 177,804 | 215 | 0.48 | % | $ | 190,667 | 673 | 0.47 | % | $ | 171,687 | 623 | 0.49 | % | |||||||||||||||||||||

| Other (2,4) | 124 | 126 | 369 | 362 | |||||||||||||||||||||||||||||||||||||

|

Total asset management and administration fees |

$ | 663 | $ | 649 | $ |

1,977 |

$ |

1,892 |

|||||||||||||||||||||||||||||||||

| (1) | Includes Schwab Exchange-traded Funds. | |

| (2) | Beginning in the second quarter of 2015, certain Mutual Fund OneSource balances were reclassified to Other third-party mutual funds. Related revenues have been reclassified to Other asset management and administration fees. Prior-period information has been recast to reflect this change. | |

| (3) | Beginning in the second quarter of 2015, Fee-based, Intelligent Portfolios and Legacy Non-Fee advice solutions are presented separately. Prior-period information has been recast to reflect this change. Advice solutions include managed portfolios, specialized strategies and customized investment advice. Fee-based advice solutions include Schwab Private Client, Schwab Managed Portfolios, Managed Account Select, Schwab Advisor Network, Windhaven Strategies, Thomas Partners Dividend Growth Strategy, and Schwab Index Advantage advised retirement plan balances. Intelligent Portfolios include Schwab Intelligent Portfolios, launched in March 2015, and Institutional Intelligent Portfolios, launched in June 2015. Legacy Non-Fee advice solutions include superseded programs such as Schwab Advisor Source and certain retirement plan balances. Average client assets for advice solutions may also include the asset balances contained in the three categories of mutual funds listed above. | |

| (4) | Includes various asset-based fees, such as trust fees, 401(k) recordkeeping fees, and mutual fund clearing fees and other service fees. | |

| N/A | Not applicable. | |

| THE CHARLES SCHWAB CORPORATION | ||||||||||||||||||||||||||

| Growth in Client Assets and Accounts | ||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||

|

Q3-15 % Change |

2015 | 2014 | ||||||||||||||||||||||||

| vs. | vs. | Third | Second | First | Fourth | Third | ||||||||||||||||||||

| (In billions, at quarter end, except as noted) | Q3-14 | Q2-15 | Quarter | Quarter | Quarter | Quarter | Quarter | |||||||||||||||||||

| Assets in client accounts | ||||||||||||||||||||||||||

| Schwab One®, certain cash equivalents and bank deposits | 15 | % | 4 | % | $ | 148.7 | $ | 143.0 | $ | 140.0 | $ | 136.0 | $ | 129.7 | ||||||||||||

| Proprietary mutual funds (Schwab Funds® and Laudus Funds®): | ||||||||||||||||||||||||||

| Money market funds | (2 | %) | 4 | % | 161.8 | 155.6 | 162.5 | 167.9 | 164.7 | |||||||||||||||||

| Equity and bond funds | - | (7 | %) | 59.3 | 64.1 | 64.1 | 61.5 | 59.1 | ||||||||||||||||||

| Total proprietary mutual funds | (1 | %) | 1 | % | 221.1 | 219.7 | 226.6 | 229.4 | 223.8 | |||||||||||||||||

| Mutual Fund Marketplace® (1) | ||||||||||||||||||||||||||

| Mutual Fund OneSource® (2) | (12 | %) | (10 | %) | 210.7 | 233.2 | 239.1 | 236.2 | 238.8 | |||||||||||||||||

| Mutual fund clearing services | 7 | % | (6 | %) | 177.8 | 188.9 | 170.6 | 164.7 | 166.3 | |||||||||||||||||

| Other third-party mutual funds (2) | 2 | % | (6 | %) | 490.4 | 519.4 | 508.3 | 486.2 | 479.4 | |||||||||||||||||

| Total Mutual Fund Marketplace | (1 | %) | (7 | %) | 878.9 | 941.5 | 918.0 | 887.1 | 884.5 | |||||||||||||||||

| Total mutual fund assets | (1 | %) | (5 | %) | 1,100.0 | 1,161.2 | 1,144.6 | 1,116.5 | 1,108.3 | |||||||||||||||||

| Exchange-traded funds (ETFs) | ||||||||||||||||||||||||||

| Proprietary ETFs | 49 | % | - | 34.2 | 34.3 | 31.0 | 26.9 | 22.9 | ||||||||||||||||||

| ETF OneSource™ (1) | 9 | % | (7 | %) | 15.4 | 16.5 | 16.1 | 14.7 | 14.1 | |||||||||||||||||

| Other third-party ETFs | 6 | % | (6 | %) | 194.6 | 207.4 | 205.3 | 194.7 | 184.2 | |||||||||||||||||

| Total ETF assets | 10 | % | (5 | %) | 244.2 | 258.2 | 252.4 | 236.3 | 221.2 | |||||||||||||||||

| Equity and other securities | (2 | %) | (7 | %) | 755.3 | 815.1 | 820.9 | 800.4 | 771.6 | |||||||||||||||||

| Fixed income securities | (2 | %) | 1 | % | 183.6 | 181.1 | 181.2 | 188.7 | 187.3 | |||||||||||||||||

| Margin loans outstanding | 10 | % | 4 | % | (15.9 | ) | (15.3 | ) | (14.7 | ) | (14.3 | ) | (14.4 | ) | ||||||||||||

| Total client assets | 1 | % | (5 | %) | $ | 2,415.9 | $ | 2,543.3 | $ | 2,524.4 | $ | 2,463.6 | $ | 2,403.7 | ||||||||||||

| Client assets by business | ||||||||||||||||||||||||||

| Investor Services | 1 | % | (5 | %) | $ | 1,330.7 | $ | 1,406.8 | $ | 1,391.2 | $ | 1,351.5 | $ | 1,323.3 | ||||||||||||

| Advisor Services | - | (5 | %) | 1,085.2 | 1,136.5 | 1,133.2 | 1,112.1 | 1,080.4 | ||||||||||||||||||

| Total client assets | 1 | % | (5 | %) | $ | 2,415.9 | $ | 2,543.3 | $ | 2,524.4 | $ | 2,463.6 | $ | 2,403.7 | ||||||||||||

| Net (decline) growth in assets in client accounts (for the quarter ended) | ||||||||||||||||||||||||||

| Net new assets | ||||||||||||||||||||||||||

|

Investor Services (3, 4) |

(27 | %) | (49 | %) | $ | 13.7 | $ | 26.8 | $ | 23.2 | $ | 13.8 | $ | 18.7 | ||||||||||||

| Advisor Services (5) | 7 | % | 68 | % | 17.1 | 10.2 | 5.5 | 19.4 | 16.0 | |||||||||||||||||

| Total net new assets | (11 | %) | (17 | %) | 30.8 | 37.0 | 28.7 | 33.2 | 34.7 | |||||||||||||||||

| Net market (losses) gains | N/M | N/M | (158.2 | ) | (18.1 | ) | 32.1 | 26.7 | (32.9 | ) | ||||||||||||||||

| Net (decline) growth | N/M | N/M | $ | (127.4 | ) | $ | 18.9 | $ | 60.8 | $ | 59.9 | $ | 1.8 | |||||||||||||

| New brokerage accounts (in thousands, for the quarter ended) | 11 | % | (9 | %) | 254 | 280 | 274 | 243 | 229 | |||||||||||||||||

| Clients (in thousands) | ||||||||||||||||||||||||||

| Active Brokerage Accounts | 4 | % | 1 | % | 9,691 | 9,605 | 9,493 | 9,386 | 9,309 | |||||||||||||||||

| Banking Accounts | 6 | % | 2 | % | 1,027 | 1,004 | 986 | 985 | 970 | |||||||||||||||||

| Corporate Retirement Plan Participants (3) | 6 | % | 1 | % | 1,492 | 1,474 | 1,474 | 1,428 | 1,405 | |||||||||||||||||

| (1) | Excludes all proprietary mutual funds and ETFs. | |

| (2) | Beginning in the second quarter of 2015, certain Mutual Fund OneSource balances were reclassified to Other third-party mutual funds. Prior-period information has been recast to reflect this change. | |

| (3) | In the first quarter of 2015, the Company increased its reported totals for overall client assets and retirement plan participants by $6.1 billion and 35,000, respectively, to reflect the final impact of the consolidation of its retirement plan recordkeeping platforms as previously announced in September 2013. | |

| (4) | Third quarter of 2015 includes an inflow of $4.9 billion from a mutual fund clearing services client. Second quarter of 2015 includes inflows of $17.4 billion from certain mutual fund clearing service clients. Third quarter of 2014 includes inflows of $10.2 billion and an outflow of $3.4 billion from certain mutual fund clearing service clients. | |

| (5) | First quarter of 2015 includes an outflow of $11.6 billion relating to the Company's planned resignation from an Advisor Services cash management relationship. | |

| N/M | Not meaningful. | |

| The Charles Schwab Corporation Monthly Activity Report For September 2015 | |||||||||||||||||||||||||||||||||||||||||||||

| 2014 | 2015 |

Change |

|||||||||||||||||||||||||||||||||||||||||||

|

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Mo. |

Yr. |

|||||||||||||||||||||||||||||||

| Market Indices | |||||||||||||||||||||||||||||||||||||||||||||

| (at month end) | |||||||||||||||||||||||||||||||||||||||||||||

| Dow Jones Industrial Average | 17,043 | 17,391 | 17,828 | 17,823 | 17,165 | 18,133 | 17,776 | 17,841 | 18,011 | 17,620 | 17,690 | 16,528 | 16,285 | (1 | %) | (4 | %) | ||||||||||||||||||||||||||||

| Nasdaq Composite | 4,493 | 4,631 | 4,792 | 4,736 | 4,635 | 4,964 | 4,901 | 4,941 | 5,070 | 4,987 | 5,128 | 4,777 | 4,620 | (3 | %) | 3 | % | ||||||||||||||||||||||||||||

| Standard & Poor’s 500 | 1,972 | 2,018 | 2,068 | 2,059 | 1,995 | 2,105 | 2,068 | 2,086 | 2,107 | 2,063 | 2,104 | 1,972 | 1,920 | (3 | %) | (3 | %) | ||||||||||||||||||||||||||||

| Client Assets | |||||||||||||||||||||||||||||||||||||||||||||

| (in billions of dollars) | |||||||||||||||||||||||||||||||||||||||||||||

| Beginning Client Assets | 2,448.3 | 2,403.7 | 2,440.6 | 2,478.8 | 2,463.6 | 2,445.0 | 2,531.1 | 2,524.4 | 2,549.3 | 2,568.8 | 2,543.3 | 2,562.5 | 2,462.4 | ||||||||||||||||||||||||||||||||

| Net New Assets (1, 2) | 10.3 | 7.9 | 10.9 | 14.4 | 9.3 | 6.8 | 12.6 | 9.1 | 10.1 | 17.8 | 9.8 | 9.2 | 11.8 | 28 | % | 15 | % | ||||||||||||||||||||||||||||

| Net Market (Losses) Gains | (54.9 | ) | 29.0 | 27.3 | (29.6 | ) | (27.9 | ) | 79.3 | (19.3 | ) | 15.8 | 9.4 | (43.3 | ) | 9.4 | (109.3 | ) | (58.3 | ) | |||||||||||||||||||||||||

| Total Client Assets (at month end) | 2,403.7 | 2,440.6 | 2,478.8 | 2,463.6 | 2,445.0 | 2,531.1 | 2,524.4 | 2,549.3 | 2,568.8 | 2,543.3 | 2,562.5 | 2,462.4 | 2,415.9 | (2 | %) | 1 | % | ||||||||||||||||||||||||||||

| Receiving Ongoing Advisory Services | |||||||||||||||||||||||||||||||||||||||||||||

| (at month end) | |||||||||||||||||||||||||||||||||||||||||||||

| Investor Services | 177.3 | 180.2 | 183.3 | 182.5 | 181.5 | 187.8 | 188.4 | 191.0 | 192.8 | 191.4 | 193.3 | 187.2 | 184.9 | (1 | %) | 4 | % | ||||||||||||||||||||||||||||

| Advisor Services (3) | 1,015.3 | 1,032.4 | 1,049.0 | 1,045.6 | 1,038.4 | 1,065.8 | 1,063.4 | 1,071.9 | 1,079.3 | 1,066.7 | 1,079.0 | 1,039.5 | 1,019.9 | (2 | %) | - | |||||||||||||||||||||||||||||

| Client Accounts | |||||||||||||||||||||||||||||||||||||||||||||

| (at month end, in thousands) | |||||||||||||||||||||||||||||||||||||||||||||

| Active Brokerage Accounts | 9,309 | 9,326 | 9,346 | 9,386 | 9,407 | 9,435 | 9,493 | 9,553 | 9,572 | 9,605 | 9,631 | 9,671 | 9,691 | - | 4 | % | |||||||||||||||||||||||||||||

| Banking Accounts | 970 | 974 | 979 | 985 | 978 | 983 | 986 | 992 | 1,000 | 1,004 | 1,011 | 1,021 | 1,027 | 1 | % | 6 | % | ||||||||||||||||||||||||||||

| Corporate Retirement Plan Participants (2) | 1,405 | 1,416 | 1,416 | 1,428 | 1,441 | 1,475 | 1,474 | 1,469 | 1,469 | 1,474 | 1,483 | 1,488 | 1,492 | - | 6 | % | |||||||||||||||||||||||||||||

| Client Activity | |||||||||||||||||||||||||||||||||||||||||||||

| New Brokerage Accounts (in thousands) | 76 | 76 | 70 | 97 | 84 | 80 | 110 | 111 | 80 | 89 | 87 | 87 | 80 | (8 | %) | 5 | % | ||||||||||||||||||||||||||||

| Inbound Calls (in thousands) | 1,755 | 1,928 | 1,656 | 1,980 | 1,872 | 1,827 | 1,930 | 1,954 | 1,621 | 1,763 | 1,788 | 1,807 | 1,631 | (10 | %) | (7 | %) | ||||||||||||||||||||||||||||

| Web Logins (in thousands) | 31,098 | 32,409 | 31,528 | 34,580 | 34,294 | 35,379 | 36,278 | 35,966 | 32,112 | 31,644 | 33,498 | 34,167 | 29,550 | (14 | %) | (5 | %) | ||||||||||||||||||||||||||||

| Client Cash as a Percentage of Client Assets (4) | 12.2 | % | 12.1 | % | 11.9 | % | 12.3 | % | 12.3 | % | 11.9 | % | 12.0 | % | 11.5 | % | 11.6 | % | 11.7 | % | 11.8 | % | 12.6 | % | 12.9 | % | 30 bp | 70 bp | |||||||||||||||||

| Mutual Fund and Exchange-Traded Fund | |||||||||||||||||||||||||||||||||||||||||||||

| Net Buys (Sells) (5, 6) | |||||||||||||||||||||||||||||||||||||||||||||

| (in millions of dollars) | |||||||||||||||||||||||||||||||||||||||||||||

| Large Capitalization Stock | 228 | 1,881 | 1,538 | 1,347 | 1,084 | (1,154 | ) | (586 | ) | (1,496 | ) | (1,410 | ) | (804 | ) | (702 | ) | (664 | ) | (608 | ) | ||||||||||||||||||||||||

| Small / Mid Capitalization Stock | (127 | ) | (307 | ) | 91 | (346 | ) | 488 | (12 | ) | 290 | 423 | (108 | ) | 78 | 149 | (540 | ) | (108 | ) | |||||||||||||||||||||||||

| International | 166 | (20 | ) | 794 | 177 | 1,630 | 3,463 | 4,650 | 3,613 | 2,718 | 2,255 | 947 | (266 | ) | (560 | ) | |||||||||||||||||||||||||||||

| Specialized | (24 | ) | 781 | 503 | 566 | 1,452 | 748 | (47 | ) | (5 | ) | 25 | 8 | 410 | (390 | ) | (643 | ) | |||||||||||||||||||||||||||

| Hybrid | - | (531 | ) | (363 | ) | (687 | ) | 180 | 138 | (284 | ) | (210 | ) | (238 | ) | (133 | ) | (152 | ) | (1,144 | ) | (726 | ) | ||||||||||||||||||||||

| Taxable Bond | (3,475 | ) | 797 | 577 | (1,914 | ) | 1,298 | 2,722 | 924 | 1,075 | 1,757 | 421 | (111 | ) | (634 | ) | (91 | ) | |||||||||||||||||||||||||||

| Tax-Free Bond | 463 | 584 | 479 | 603 | 598 | 471 | 613 | 13 | (101 | ) | (132 | ) | 156 | 111 | 35 | ||||||||||||||||||||||||||||||

| Net Buy (Sell) Activity | |||||||||||||||||||||||||||||||||||||||||||||

| (in millions of dollars) | |||||||||||||||||||||||||||||||||||||||||||||

| Mutual Funds (5) | (4,022 | ) | 358 | 254 | (4,381 | ) | 3,174 | 3,086 | 1,765 | 420 | 813 | (725 | ) | (1,101 | ) | (4,712 | ) | (4,336 | ) | ||||||||||||||||||||||||||

| Exchange-Traded Funds (6) | 1,253 | 2,827 | 3,365 | 4,127 | 3,556 | 3,290 | 3,795 | 2,993 | 1,830 | 2,418 | 1,798 | 1,185 | 1,635 | ||||||||||||||||||||||||||||||||

| Money Market Funds | 2,224 | 477 | (1,643 | ) | 4,294 | (2,080 | ) | (2,158 | ) | (1,362 | ) | (6,970 | ) | 421 | (358 | ) | 2,208 | 4,730 | (717 | ) | |||||||||||||||||||||||||

| Average Interest-Earning Assets (7) | |||||||||||||||||||||||||||||||||||||||||||||

| (in millions of dollars) | 140,115 | 141,502 | 141,884 | 144,695 | 147,495 | 148,911 | 152,247 | 152,697 | 153,466 | 155,369 | 158,238 | 160,638 | 162,639 | 1 | % | 16 | % | ||||||||||||||||||||||||||||

| (1) |

September 2015 includes an inflow of $4.9 billion from a mutual fund clearing services client. June 2015 includes an inflow of $8.1 billion from a mutual fund clearing services client. April 2015 includes inflows of $9.3 billion from certain mutual fund clearing service clients. February 2015 includes an outflow of $11.6 billion relating to the Company's planned resignation from an Advisor Services cash management relationship. September 2014 includes an inflow of $7.8 billion and outflow of $3.4 billion from certain mutual fund clearing service clients. |

|

| (2) |

In February 2015, the Company increased its reported totals for overall client assets and retirement plan participants by $6.1 billion and 35,000, respectively, to reflect the final impact of the consolidation of its retirement plan recordkeeping platforms as previously announced in September 2013. |

|

| (3) | Excludes Retirement Business Services Trust. | |

| (4) | Schwab One®, certain cash equivalents, bank deposits and money market fund balances as a percentage of total client assets. | |

| (5) | Represents the principal value of client mutual fund transactions handled by Schwab, including transactions in proprietary funds. Includes institutional funds available only to Investment Managers. Excludes money market fund transactions. | |

| (6) | Represents the principal value of client ETF transactions handled by Schwab, including transactions in proprietary ETFs. | |

| (7) | Represents total interest-earning assets on the Company's balance sheet. |